It seems that the traditional New Year's Eve rally in the stock market did not take place this year. Traders and investors become less active ahead of the New Year.

The last strong movements in the market were observed last week, when a number of important macro data on the United States were published, and the Bank of Japan made an unexpected decision to expand the range of yields on Japanese government bonds. Then it caused a sharp strengthening of the yen, which also affected the dollar index DXY (the share of the yen in the DXY, as you know, is about 14%). On that day (December 20), DXY declined sharply, losing almost 1% to the closing price of the previous day.

Although the interest rate was kept at -0.10%, and the head of the BOJ Haruhiko Kuroda tried to calm the markets, traditionally stating that the bank's management "will not hesitate to continue easing monetary policy if necessary," the market perceived such actions as the beginning of a possible rejection of ultra-loose monetary policy.

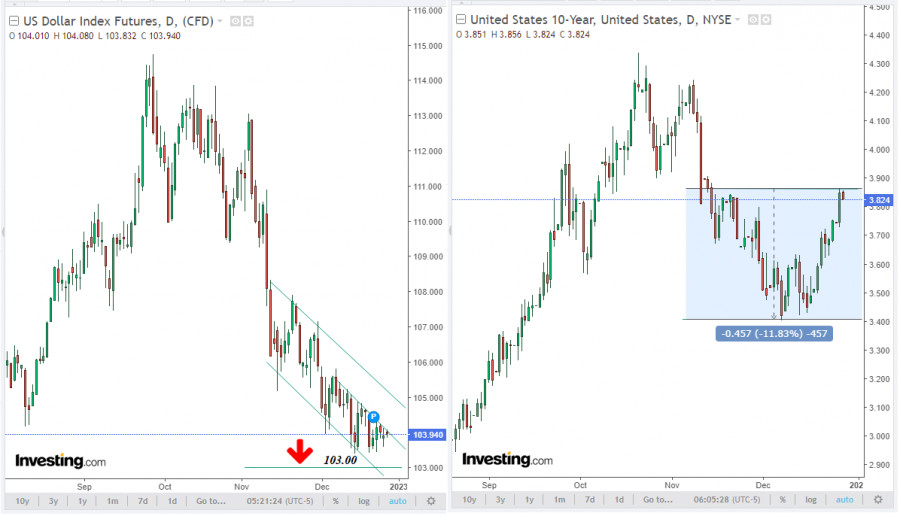

The dollar remains under pressure, and the dollar index DXY continues to move in a downward channel, towards its lower limit and the 103.00 mark.

Last week's rather positive macro data from the US was not able to support the dollar much. Thus, according to the US Bureau of Economic Analysis, GDP in Q3 (final estimate) grew by +3.2%, which was better than the previous estimate of +2.9%.

The weekly report from the US Department of Labor was also better than expected with initial jobless claims at 216,000, below the forecast of 222,000 and jobless claims at 1.672 million versus 1.678 million a week earlier. The data shows that the U.S. labor market is resilient to the global risks of recession and the Federal Reserve's current monetary policy stance is tight.

Still, the dollar is declining. The surge in U.S. government bond yields in recent days, which is associated with an increasing volume of sales, still helps the U.S. dollar to maintain its market position: on Tuesday, the yield on popular U.S. 10-year bonds reached 3.862% (vs. 3.410% at the beginning of December).

However, after the Fed's December meeting at which policymakers decided to lower the pace of monetary tightening by raising the interest rate by 0.50% (after raising the rate by 0.75% in June, July, September and November), economists are already predicting that the central bank will cut the rate hikes again in early 2023, moving to 0.25% hikes in February and March. Many economists also believe that a U.S. recession in 2023 would result in an even greater drop in the dollar, although demand is still quite high given the tense global geopolitical situation.

The Chinese authorities' decision to ease covid restrictions helped improve investor sentiment. But the situation in China is worrisome, given the extreme overcrowding of medical facilities and the continuing rise in the number of coronavirus cases in the country.

In the current situation, however, it is not just the dollar that is in demand as a safe haven asset.

High levels of geopolitical tension in the world and the growing risks of a deep recession amid high inflation are also forcing investors to seek refuge in buying precious metals.

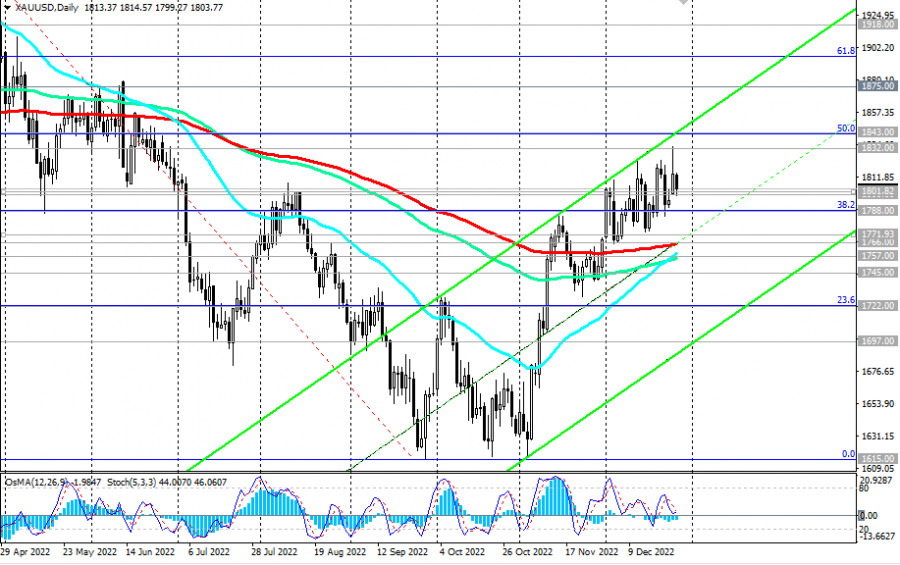

But gold is not falling behind, trading in the bull market zone and above the psychological mark of 1800.00 dollars per ounce.

A strong bullish momentum prevails in gold and XAU/USD quotes, despite expectations of further interest rate hikes by the world's major central banks: this precious metal is known to be extremely sensitive to changes in monetary policy, especially by the Fed, and usually declines when interest rates rise.

According to the U.S. Commodity Futures Trading Commission (CFTC), private investors have also stepped up purchases of gold. Last week, the number of contracts to buy rose 1,290, with total positions coming in at 128,800 from 125,600 the week before.

At the time of writing, the pair was trading near 1,804.00, staying in the bull market zone, above the key support levels of 1,800.00, 1,766.00 and 1,697.00.

A breakdown of Wednesday's local high at 1814.00 would be a signal to build up long positions.