In my morning forecast, I focused on the 1.0952 level and planned to make trading decisions from that point. Let's look at the 5-minute chart and analyze what happened. The rise and formation of a false breakout around 1.0952 provided a good entry point for selling the euro, resulting in a 25-point drop, representing nearly all of the intraday volatility. The technical outlook was not revised for the second half of the day.

To open long positions on EUR/USD:

The lack of significant data has limited the upward potential of the euro, which was expected. Ahead, we have another inflation report on the U.S. Producer Price Index, inflation expectations from the University of Michigan, and the Consumer Sentiment Index. If inflation rises, the euro could face new challenges. Speeches from FOMC members Austan D. Goolsbee and Michelle Bowman will wrap up the day. I plan to act similarly to my approach in the first half of the day. If the pair declines and reacts bearishly to the data, a false breakout around the 1.0918 support will be a good opportunity to increase long positions, opening the way to the 1.0952 level, which it couldn't surpass earlier today. A breakout and retest of this range would signal a good entry point for buying, aiming for a move towards 1.0979. The next target is the 1.1011 high, where I will take profits. If EUR/USD continues to decline and lacks activity near 1.0918 in the second half of the day, pressure on the euro will persist. In such a case, I will enter only after a false breakout near the next support at 1.0884. I plan to open long positions on a rebound from 1.0855, anticipating an upward correction of 30-35 points intraday.

To open short positions on EUR/USD:

Sellers have maintained their control over the market. If inflation data is very soft, the euro might see a temporary rise, which, combined with a false breakout around 1.0952 as discussed above, will provide a good entry point for opening new short positions with a potential further decline towards the 1.0918 support. A breakout and consolidation below this range, followed by a retest from below, would provide another good selling opportunity, targeting 1.0884 and further reinforcing the bearish market. I expect stronger buying interest only around this level. The next target is the 1.0855 level, where I will take profits. If EUR/USD rises in the second half of the day and bears fail to defend 1.0952, buyers will have a chance to slightly strengthen the pair at the end of the week. In that case, I'll postpone selling until the next resistance test at 1.0979. I will sell there as well, but only after a failed consolidation. I plan to open short positions on a rebound from 1.1011, aiming for a downward correction of 30-35 points.

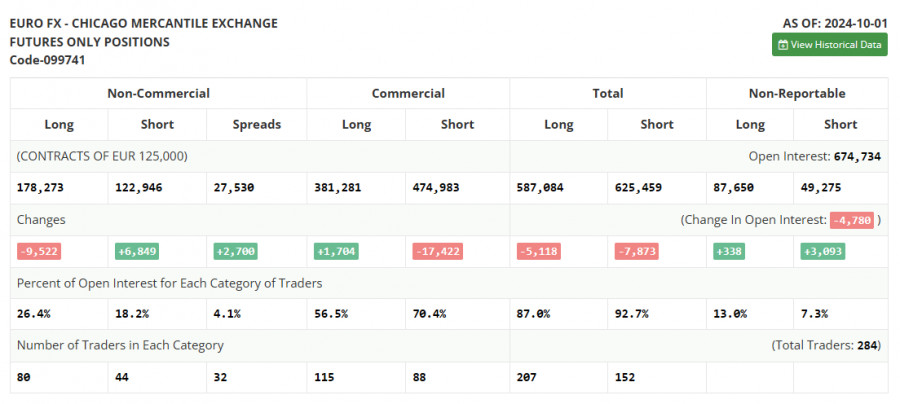

The COT report (Commitment of Traders) for October 1 showed a slight increase in short positions and a sharp decrease in long positions, leading to a shift in market balance towards sellers. Clearly, recent data on the U.S. labor market, which exceeded economists' forecasts, now holds key importance for the Federal Reserve's future decisions, which are likely to be more measured and predictable. Most likely, the central bank will adopt a more cautious approach to rate cuts in the future, which could positively impact the U.S. dollar's strength. However, this does not negate the medium-term uptrend for the pair, and the lower the pair goes the more attractive it becomes for buying. The COT report indicated that long non-commercial positions decreased by 9,522 to 178,273, while short non-commercial positions increased by 6,849 to 122,946. As a result, the gap between long and short positions increased by 2,700.

Indicator Signals:

Moving Averages:

The pair is trading near the 30- and 50-day moving averages, indicating market uncertainty.

Note: The period and price of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In the case of a decline, the lower boundary of the indicator around 1.0918 will act as support.

Indicator Descriptions:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50, marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): EMA Fast period 12, EMA Slow period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.

- Long non-commercial positions: Represents the total long open position of non-commercial traders.

- Short non-commercial positions: Represents the total short open position of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.